CASITAS MODELS

REVIEW OUR CUSTOM CASITAS FOR OUR CLIENTS

SAGUARO

380 Sq Ft

1 Bed / 1 Bath

HORSE SHOE BEND

500 Sq Ft

1 Bed / 1 Bath

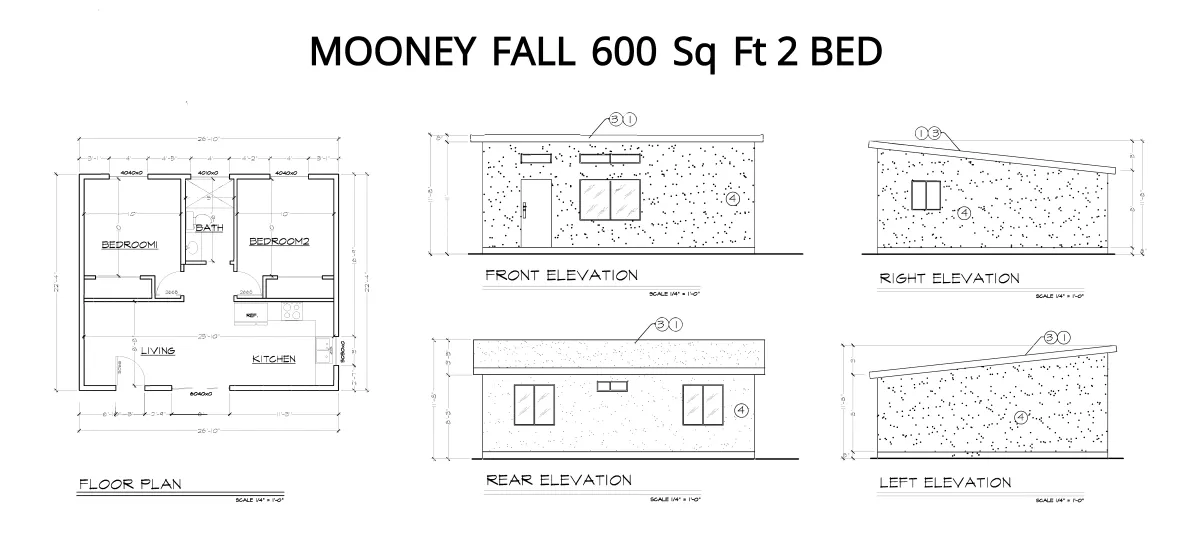

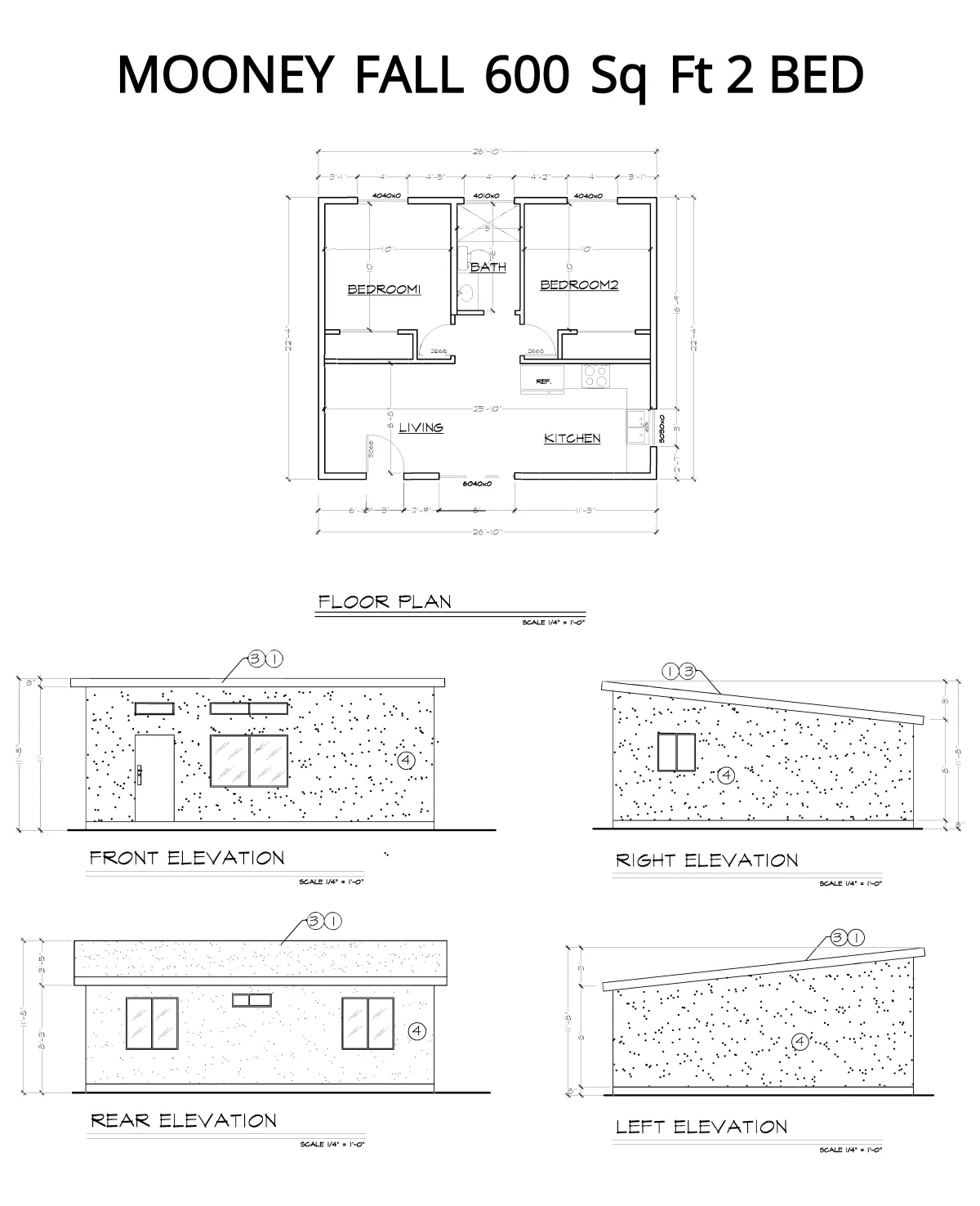

MOONEY FALL

600 Sq Ft

2 Bed / 1 Bath

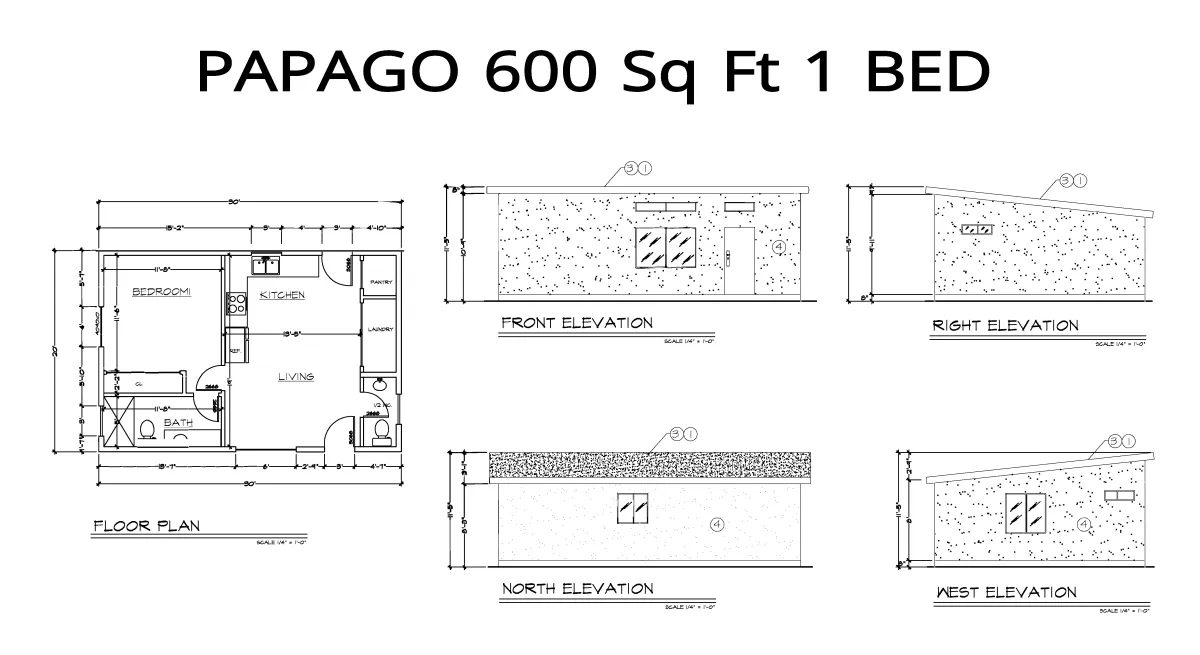

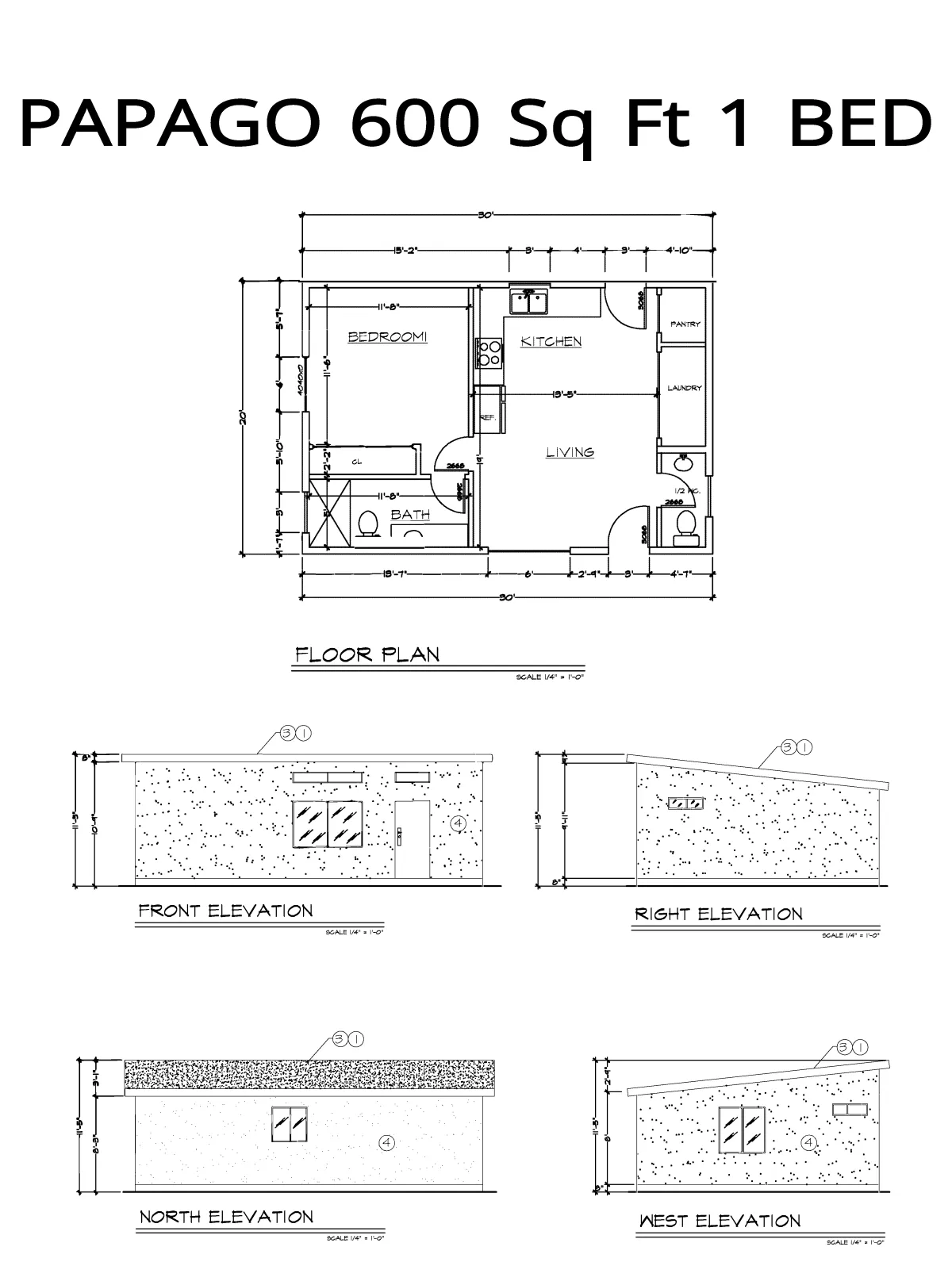

PAPAGO

600 Sq Ft

1 Bed / 1 Bath

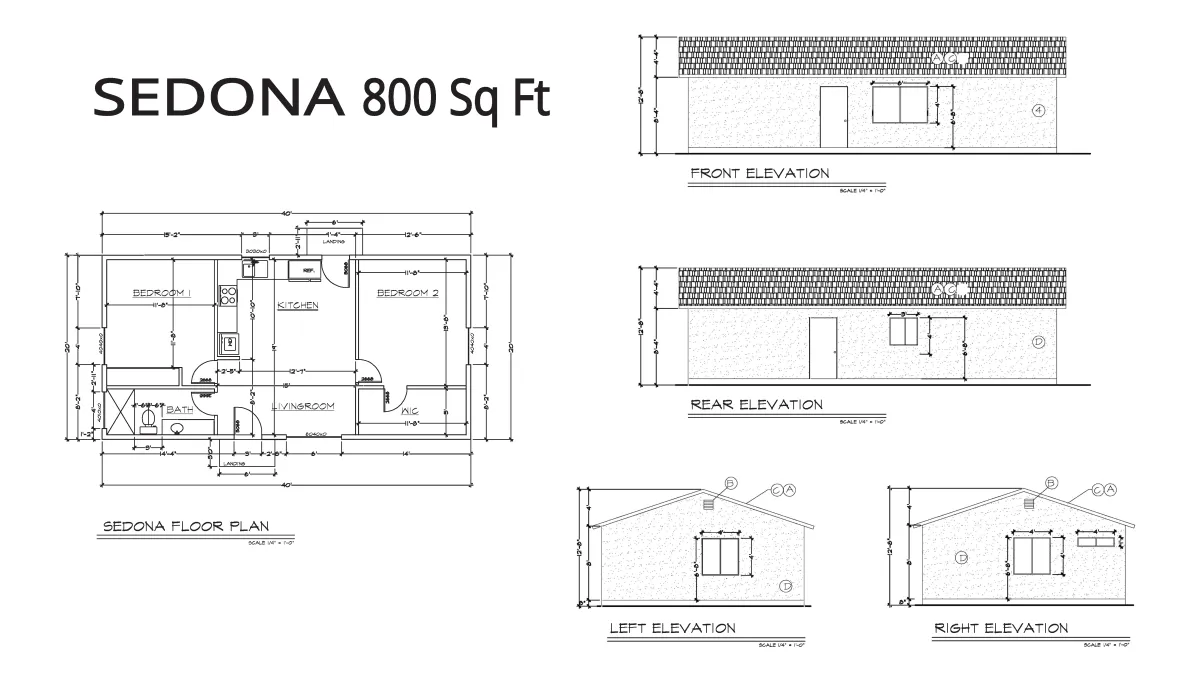

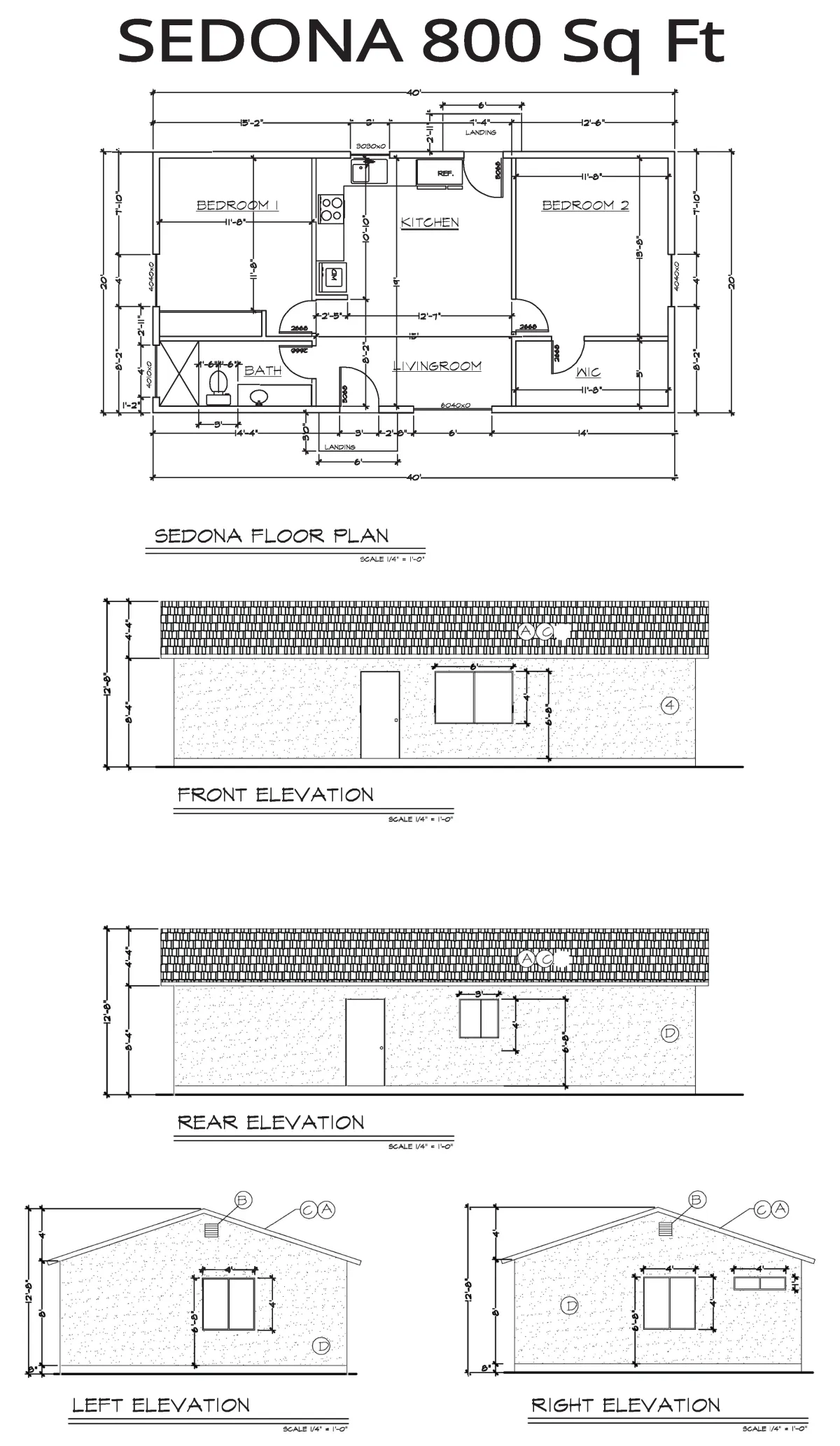

SEDONA

800 Sq Ft

2 Bed / 1 Bath

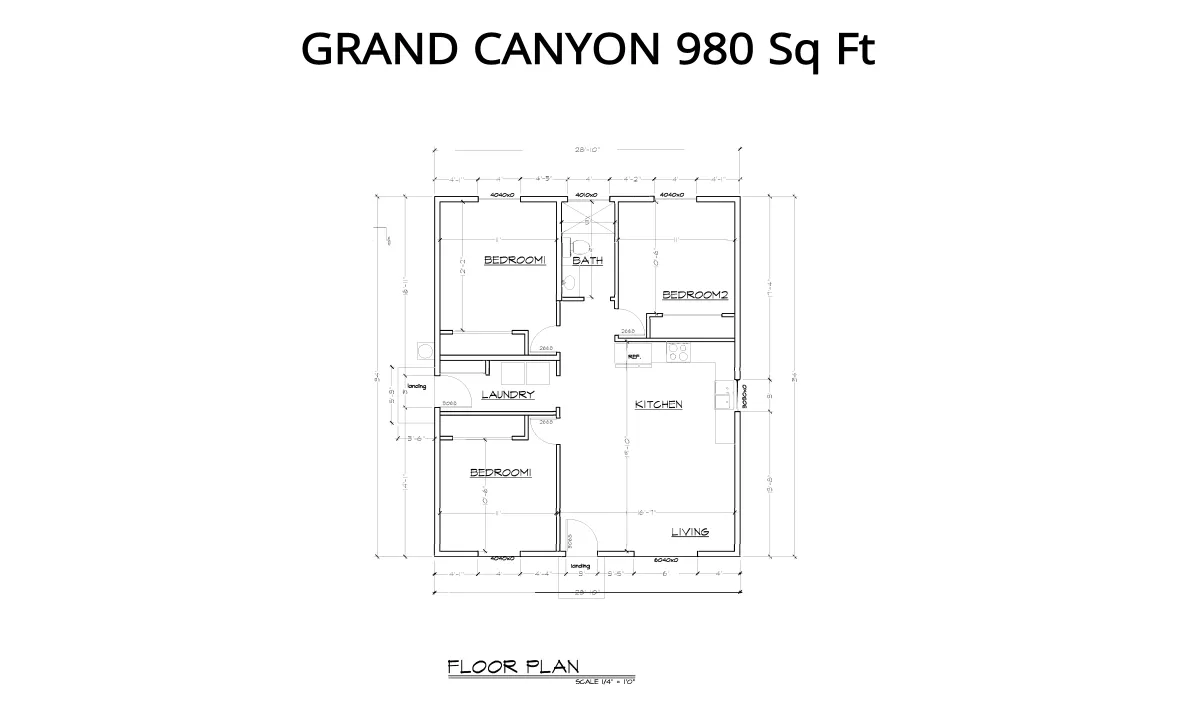

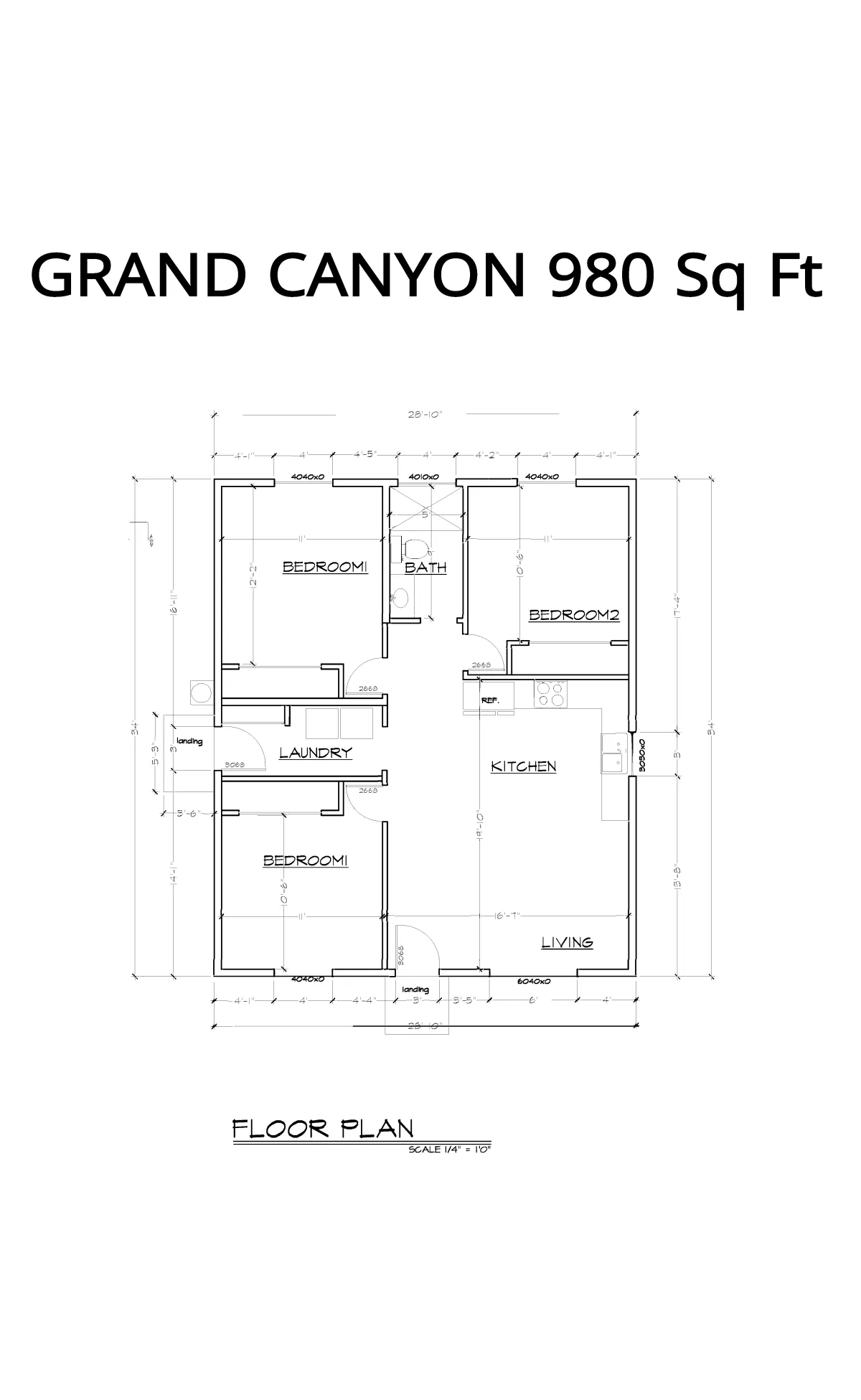

GRAND CANYON

980 Sq Ft

3 Bed / 1 Bath

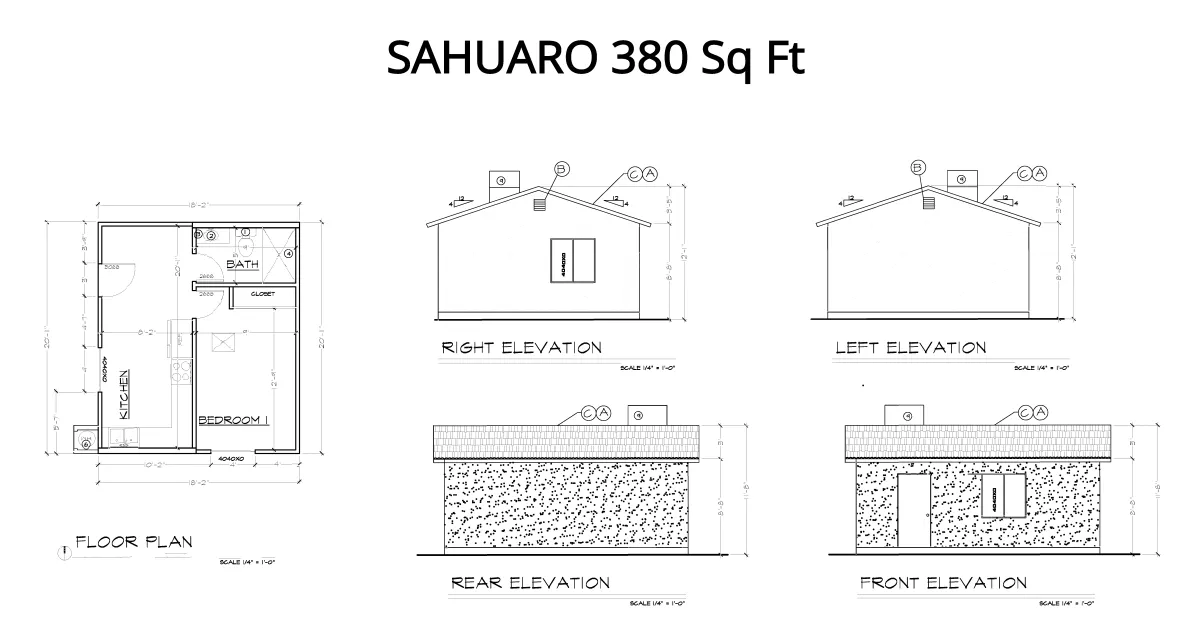

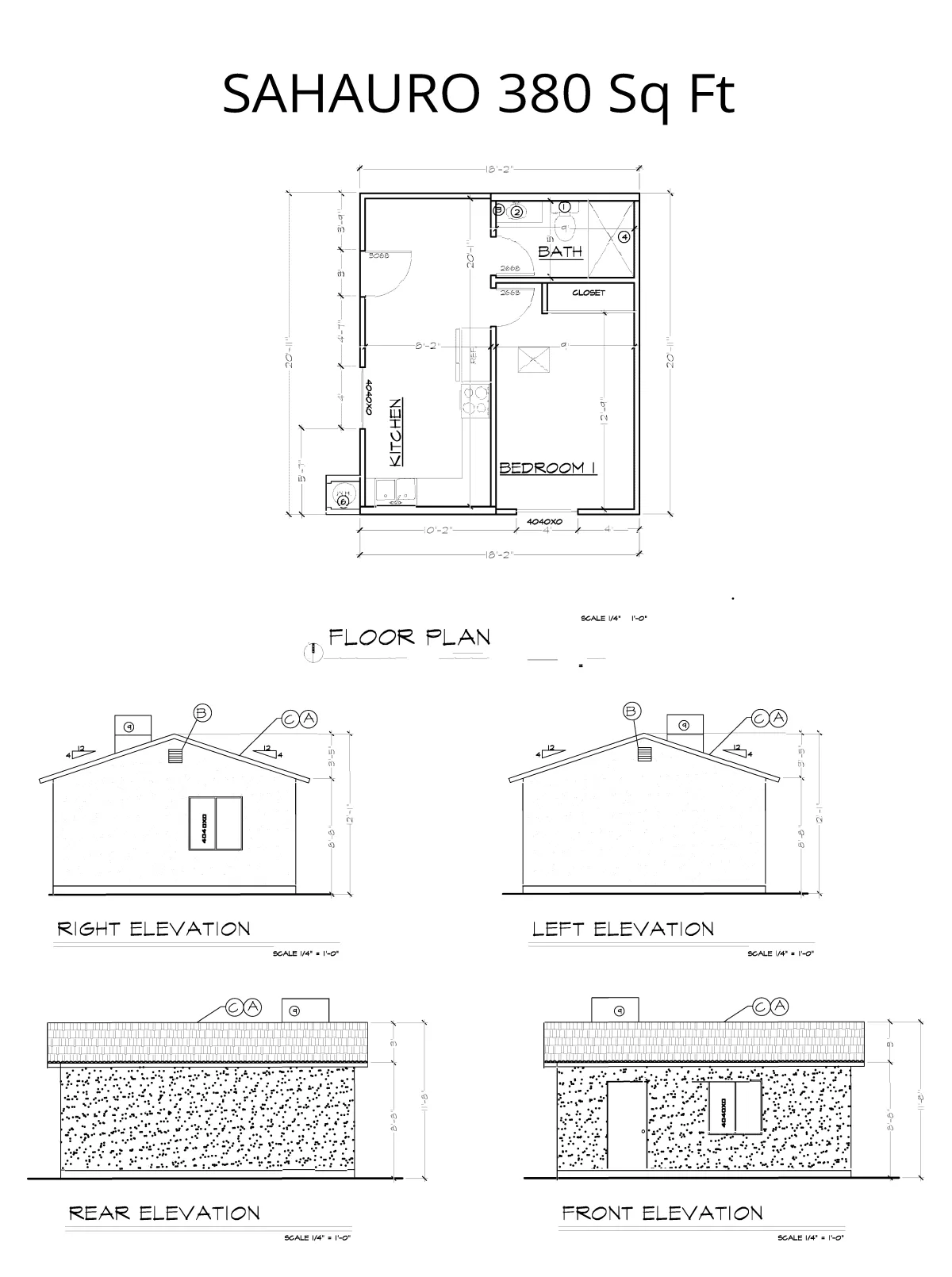

SAHAURO

1 BEDROOM, 380 SQ FT

SAHUARO (380 Sq Ft)

SAGUARO

(380 Sq Ft)

To schedule a FREE in-house consultation at your home or our office click the link below.

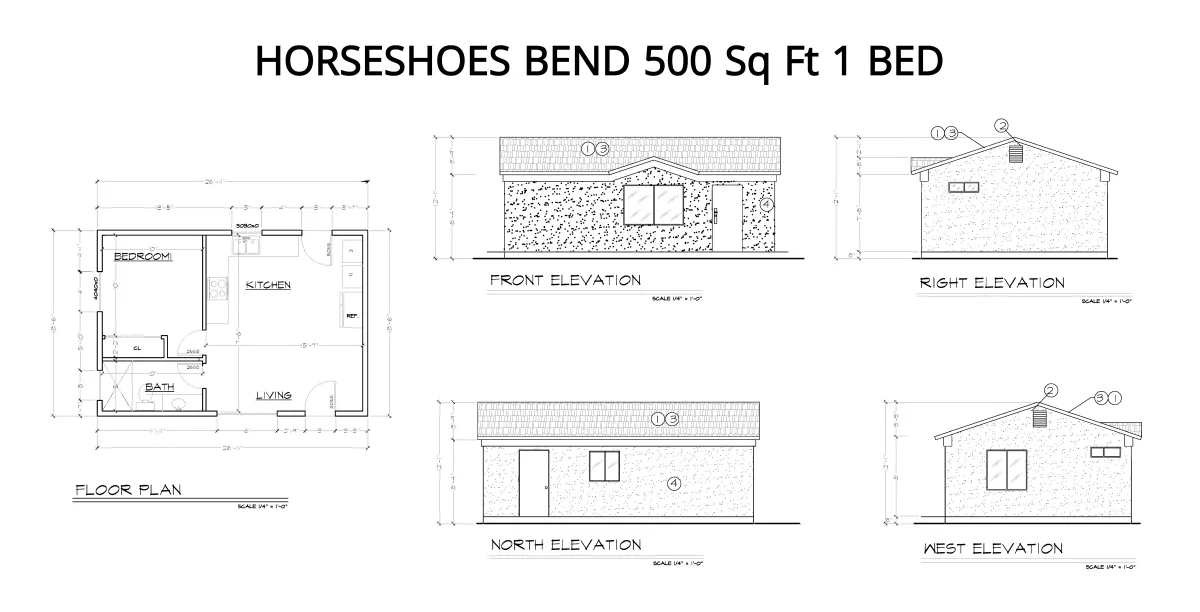

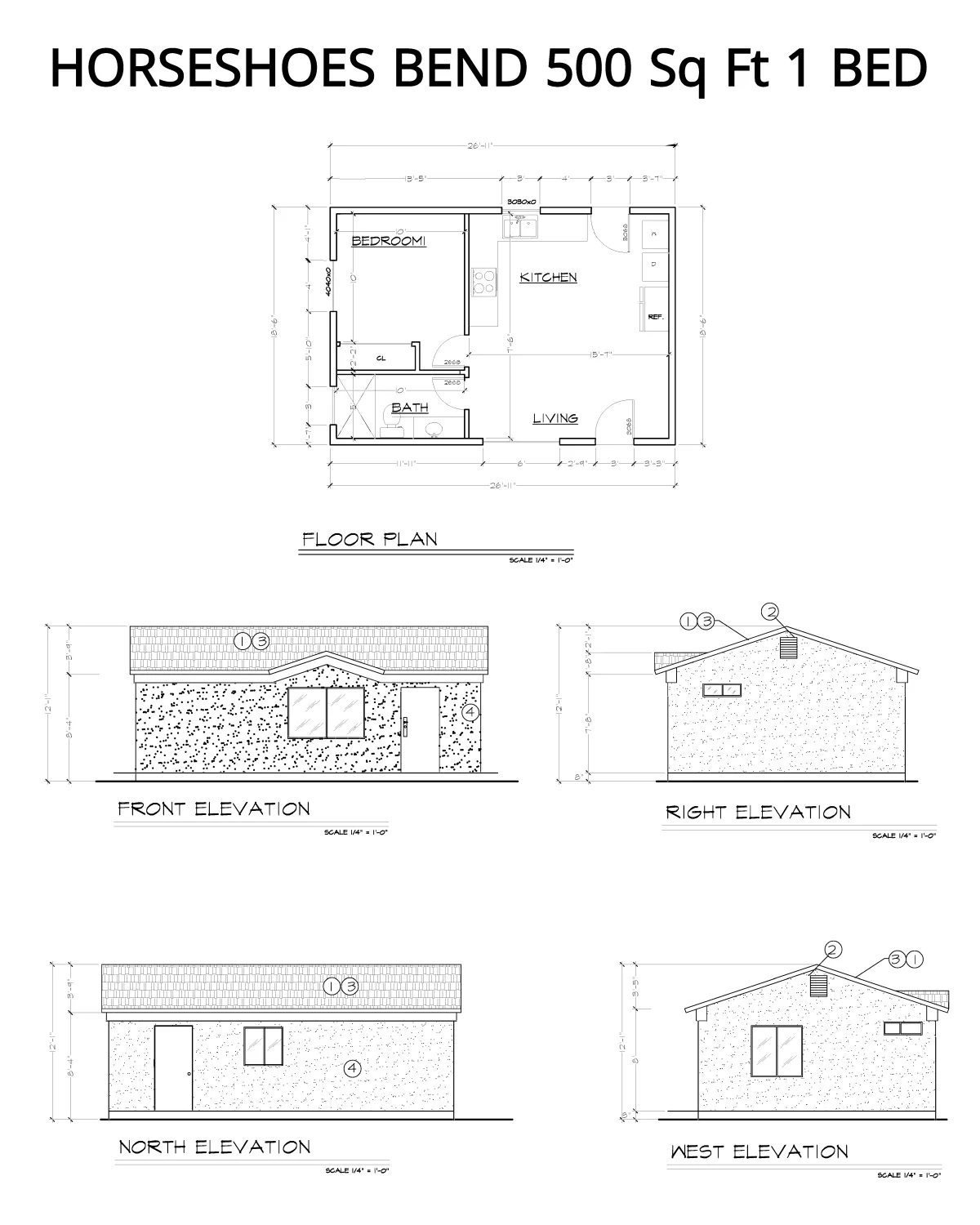

HORSESHOE BEND

1 BEDROOM, 500 SQ FT

HORSE SHOE BEND (500 Sq Ft)

HORSE SHOE BEND

(500 Sq Ft)

To schedule a FREE in-house consultation at your home or our office click the link below.

MOONEY FALL

1 BEDROOM, 600 SQ FT

MOONEY FALL (600 Sq Ft)

MOONEY FALL

(600 Sq Ft)

To schedule a FREE in-house consultation at your home or our office click the link below.

PAPAGO

1 BEDROOM, 600 SQ FT

To schedule a FREE in-house consultation at your home or our office click the link below.

SEDONA

1 BEDROOM, 600 SQ FT

To schedule a FREE in-house consultation at your home or our office click the link below.

GRAND CANYON

1 BEDROOM, 600 SQ FT

To schedule a FREE in-house consultation at your home or our office click the link below.

Testimonials

Jasmine Richards

SunFlower hooked me up with a great first-home loan. Super informative and made the scary stuff easy. Highly recommend for newbies!

Monica Chandler

Tried a few lenders before, but SunFlower’s first-time buyer perks and smooth refinance process really stand out. Definitely worth considering for effortless financing.

Thomas Krazinski

SunFlower Mortgage streamlined my investment property loan process. Efficient and straightforward service - exactly what I needed for expanding my real estate investments.

FAQs

Answers to Help You Navigate Your Mortgage Journey

What are the requirements to qualify for a mortgage with SunFlower Mortgage?

Requirements vary, typically needing a credit score of 620+, stable income, and a reasonable debt-to-income ratio.

How do I know which type of mortgage is best for me?

The best mortgage depends on your financial situation, home stay duration, and down payment capability. We offer consultations to help choose.

Can I get a mortgage if I have a poor credit history?

Yes, options are available for individuals with poor credit. Programs like FHA loans are designed specifically for buyers with lower credit scores. We can also provide you with advice on how to improve your credit.

What are the current mortgage rates?

Mortgage rates fluctuate based on market conditions and your personal credit profile. Contact us for specific rates.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has a constant interest rate and monthly payments that never change throughout the loan term, while an ARM offers a lower initial rate that adjusts after a specific period based on a financial index.

How long does the loan process take with SunFlower Mortgage?

We have loan products that can be funded in as little as one week. The typical mortgage process usually takes between 30 to 45 days from application to closing.